LBPs (Liquidity Bootstrapping Pools)

List of LBPs for tokens and NFTs

Overview

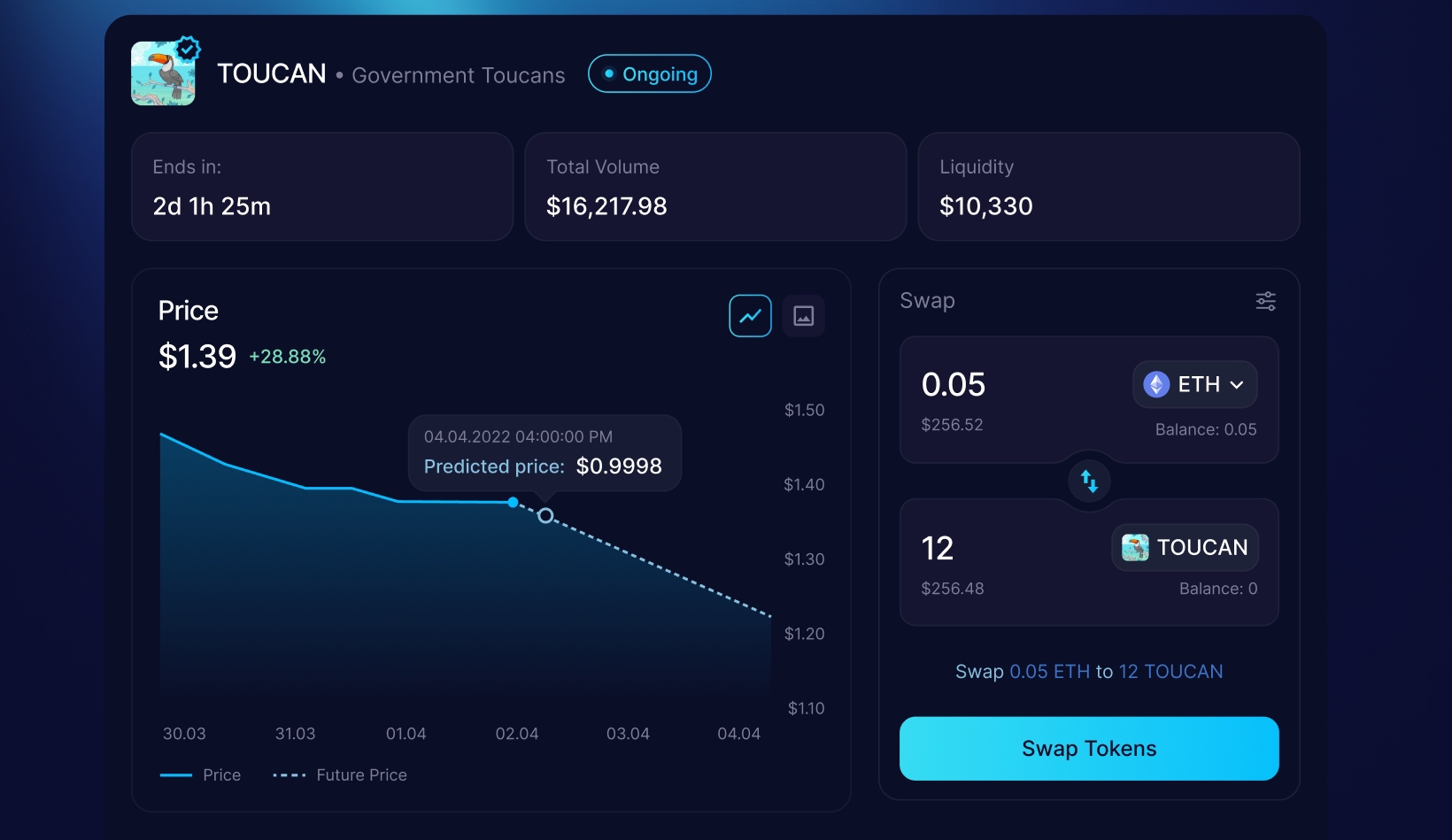

Evolving Proteus can be utilized to raise liquidity and distribute tokens or NFTs to a community. This is achieved through liquidity bootstrapping pools (LBPs). LBPs begin with a pool containing 100% of one token type and 0% of the other. Over time, the pool rebalances by altering the liquidity curve to gradually sell off the initial token in exchange for the second token. The price is determined by the market, based on the demand for the first token, at each stage of the rebalancing process. An LBP is a type of Dutch auction.

However, whereas existing LBPs are limited to simple curve shapes like constant product, Evolving Proteus can be used to create evolving pools with highly customized concentrated liquidity.

For instance, imagine creating a new fungible token named SURF. You could set up an Evolving Proteus pool filled with SURF token liquidity. If this pool pairs SURF with Ether, the price of SURF would decrease over time until the pool reaches a predetermined balance point, such as a 50-50 ratio or becoming 100% Ether.

This model is also applicable to NFTs. By integrating Evolving Proteus with the Shell Fractionalizer, one can orchestrate the sale of new NFT collections. For example, if you have 10,000 Hermit Crab NFTs, you could fractionalize them into fungible tokens and set up an LBP for those tokens just like you would for the SURF token. This allows users to buy the fungible tokens, which they can then redeem for the NFT of their choice. Furthermore, you could streamline the user experience by creating a user interface that masks the underlying fungible tokens, allowing direct purchase of NFTs at dynamically changing prices as the LBP evolves.

Our goal is to develop a browser-based interface for creating these types of pools, making it easier than ever to take advantage of these powerful features with little to no coding.

Primitives

This section is under construction.

Last updated